Join the Fortis Family.

Become a Gospel Partner.

You are not a customer.

You are not a donor.

You are not a file number.

If you support this ministry either prayerfully or financially, you are a Gospel Partner!

DONATE

TOGETHER, we

are partners in

the Gospel

Just as Paul considered the Phillipians "partners in the Gospel," we do not think of those who support us as mere donors.

Gospel Gifts

- CREDIT CARD

- PAYPAL

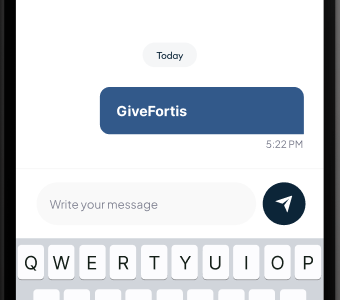

- TEXT

- LARGE GIFTS

- DONATE STOCK

- LEGACY GIVING

- CHARITABLE FUND GIVING

Text the word "GiveFortis" to 44321

Send by mail to:

Fortis Institute 3070 Windward Plaza F301

Alpharetta, GA 30005

If you are considering a more substantial gift to Fortis Institute, you may have some questions you would like answered. We would be honored to answer those questions. Simply send an email to:

and indicate how you would like to communicate (phone, email, face to face).

Whether you decide to support us or not, please know we are honored that you are thinking of us.

Thank you for considering us for your donation in the form of stock shares.

Gospel Partners Media is now ”doing business as” Fortis Institute, but our business, EIN, and tax registration is still Gospel Partners Media.

Your tax receipt will be generated by Gospel Partners Media.

Please know that any donated stocks will be used for the general support and operating budget for Fortis Institute.

If you have a Fidelity account:

- Call Fidelity at 1 (800) 972-2155 and give them our account name and number, and they will transfer the stocks for you out of your account and into our account.

See the information below for our Fidelity account name and number.

2. In order to receive a tax receipt for the donation, please send an email to [email protected] detailing the transaction information and your name and email address.

If you do not have a Fidelity account:

- Call your broker and give them the Fidelity DTC number, as well as our account name and number at Fidelity.

See the information below for our Fidelity account name and number.

2. Your broker will transfer the stock to our account at Fidelity.

3. In order to receive a tax receipt for the donation, please send an email to [email protected] detailing the transaction information and your name and email address.

Account name and number

Fidelity DTC#: 0226 Account number: Z50857831

Name on our Account: Gospel Partners Media (not Fortis Institute) Tax ID number: 45-3788065

Fidelity DTC#: 0226 Account number: Z50857831

Name on our Account: Gospel Partners Media

(not Fortis Institute) Tax ID number: 45-3788065

Fidelity DTC#: 0226

Account number: Z50857831

Name on our Account: Gospel Partners Media (not Fortis Institute)

Tax ID number: 45-3788065

We are honored with your interest in making a legacy gift to support Fortis Institute.

Gospel Partners Media is now ”doing business as” Fortis Institute, but our business, EIN, and tax registration is still Gospel Partners Media.

Here's what you can do:

Will or Trust

Naming Gospel Partners Media in your will or trust is a simple way that you can maintain your support for generations to come. Your gift can be a percentage of your estate, a specific dollar amount, a specific asset, or the remainder of your estate after other distributions. The following information can help you place Gospel Partners Media in your will or trust:

- Gospel Partners Media’s Tax ID number is 45-3788065

- Gospel Partners Media is a 501(c)(3) tax-exempt organization operating as a Georgia nonprofit corporation.

- The following is a sample of what you can use in your will or trust:

I give the sum of _________% of my estate* to Gospel Partners Media, Attn: Development Department, 3070 Windward Plaza STE F301, Alpharetta, GA 30005, to be used for its work and ministries.

*You may substitute a dollar amount in place of a percentage. - Please consult an attorney if you have questions about creating or amending your will or trust.

- Gospel Partners Media is the 501(c)(3) that issues tax receipt’s and holds the EIN attached to the 501(c)(3).

Retirement Accounts

An excellent way to make a legacy gift is by naming Gospel Partners Media as a direct or contingent beneficiary of your retirement plan or IRA. Retirement accounts are typically the best assets to leave to charity as they are the most heavily taxed assets in your estate. If you were to name Gospel Partners Media as a beneficiary of your retirement account, you would avoid all tax on the amount distributed to Gospel Partners Media while providing a lasting legacy to the ministry.

Changing your beneficiary designation requires minimal paperwork and can even be accomplished online if your account offers that service.

Gospel Partners Media is the 501(c)(3) that issues tax receipt’s and holds the EIN attached to the 501(c)(3).

Life Insurance

A gift of your life insurance policy provides a unique opportunity to support the ongoing ministry of Gospel Partners Media. Such a legacy gift is simple to arrange and does not require the services of an attorney or related legal costs. By designating Gospel Partners Media as the primary or contingent beneficiary of a life insurance policy, the size of the gift is assured in advance—it will not depend on the fluctuations of the market or other economic factors.

Since the donation is made outside of your will or trust, it guarantees that your wishes will be carried out immediately and as intended. The policy will be included in your taxable estate when you pass away, but your estate will benefit from an estate-tax charitable deduction for the value of the gift to Gospel Partners Media.

Gospel Partners Media is the 501(c)(3) that issues tax receipt’s and holds the EIN attached to the 501(c)(3).

For more information or assistance with your planned giving, contact:

Giving to Fortis Institute via a Donor Advised Fund (DAF) or a Charitable Fund is easy!

Simply instruct your fund manager to send your donation using Gospel Partners Media

(EIN: 45-3788065). (Do not search for Fortis Institute as it is merely our D/B/A).

Contact us anytime by email at: [email protected]

Did you know?

Fortis Institute is audited every year to ensure that your giving is not wasted on frivolous things. We strive to keep ourselves accountable to our Gospel Partners.